With zero duty set to reshape trade between New Zealand and India, most conversations stop at tariffs. In practice, that’s where the real work begins. Once duties fall to zero, businesses don’t just change prices—they change how they choose partners, manage risk, plan capacity, and commit to long-term trade.

This article focuses on what actually changes on the ground after zero duty comes into effect. Not the policy text, not the headlines—but the operational shifts that determine who benefits consistently and who struggles to convert opportunity into outcomes.

Read: India– New Zealand FTA: Zero Duty on Indian Exports — What It Means for Trade, MSMEs & Manufacturers

From Policy to Reality — How Trade Actually Changes After Zero Duty

When tariffs are removed, trade doesn’t instantly become easier; it becomes more selective. Zero duty lowers the barrier to entry, but it raises the bar for participation.

Here’s what shifts in real trade behavior:

- Decision-making moves upstream. Buyers evaluate partners earlier and more rigorously because tariff advantages are no longer the differentiator.

- Relationships lengthen. With tariff risk reduced, companies prefer multi-year arrangements over spot transactions.

- Process quality matters more than promises. Documentation discipline, origin clarity, and repeatability become table stakes.

In short, zero duty transforms trade from a price-led activity into a process-led partnership. Businesses that relied on tariff arbitrage must now compete on reliability and structure.

Cost Structures Change — But Not the Way Most Businesses Expect

A common assumption is that zero duty triggers aggressive price drops. In reality, the biggest change is cost predictability, not discounts.

What actually happens:

- Tariff volatility disappears, making landed costs more stable over time.

- Margins normalize rather than spike; savings are planned, not opportunistic.

- Risk-adjusted pricing improves, because fewer surprises mean fewer buffers built into quotes.

Businesses that chase immediate price cuts often miss the deeper advantage: planning confidence. With zero duty in place, companies can commit to tooling, capacity, and long-term programs—moves that create durable value well beyond a one-off saving.

Zero duty changes the rules — but not everyone benefits equally.

Companies that understand how trade behaves after tariffs are removed gain a structural advantage. Execution matters more than announcements.

Supplier and Partner Expectations Rise After Zero Duty

When tariffs drop to zero, price stops doing the heavy lifting. What replaces it is a sharper focus on who can be trusted over time. In practice, businesses become more selective about the partners they work with—because the cost advantage is now shared by many.

After zero duty, partners are evaluated on:

- Origin confidence: clear, defensible proof that goods qualify under FTA rules

- Documentation discipline: consistency across invoices, classifications, and shipping records

- Operational reliability: the ability to deliver the same outcome repeatedly, not just once

- Communication cadence: transparency around timelines, changes, and risks

This is why casual or opportunistic relationships tend to fade after zero duty takes effect. Businesses prefer partners that can support repeatable trade, not just competitive quotes.

Read: 10 Things Every Manufacturer Must Know About New Zealand–India Zero Duty Trade

Trade Risk Doesn’t Disappear — It Gets Reallocated

Zero duty removes tariffs, but it does not remove scrutiny. In many cases, it increases it. As preferential trade expands, enforcement tightens to ensure benefits are applied correctly.

What changes in risk profiles:

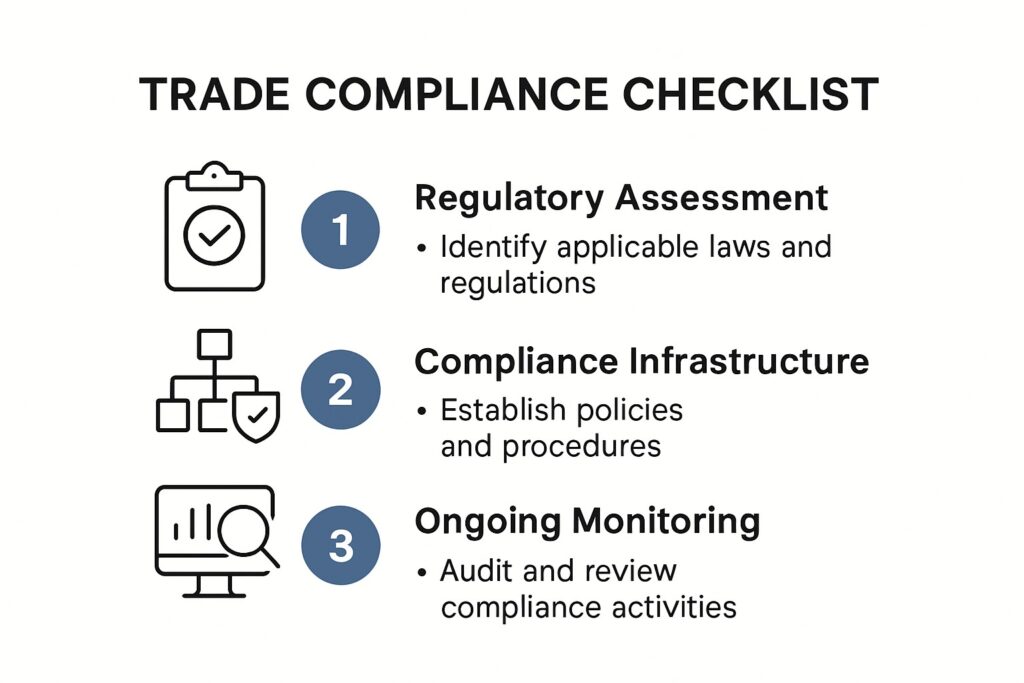

- Compliance risk rises: origin, classification, and documentation are examined more closely

- Reputational risk grows: partners that trigger audits or delays are avoided

- Operational risk shifts upstream: problems surface earlier in partner selection

The implication is clear: businesses without structured processes feel more friction after zero duty, not less. Those with clear controls and repeatable workflows navigate the shift smoothly and build confidence with every shipment or transaction.

Understanding zero duty is easy. Applying it correctly is not.

Businesses that align partners, documentation, and processes early avoid costly missteps once trade volumes increase.

What Early Movers Are Doing Differently

Across New Zealand–India trade corridors, a clear pattern is emerging: the businesses that benefit most from zero duty are the ones that moved before it fully arrived. They didn’t wait for tariffs to drop to start changing how they operate.

Early movers typically focus on:

- Pre-alignment, not reaction. They align partners, processes, and documentation well before trade volumes increase.

- Consistency over experimentation. Instead of testing multiple short-term options, they commit to fewer, more reliable relationships.

- Operational rehearsal. They treat early transactions as dry runs—fixing gaps before scale magnifies them.

- Long-term economics. They model trade over years, not shipments, using zero duty as a stabilising factor rather than a one-off gain.

The result is compounding advantage. Once zero duty is live, these businesses are already embedded in stable trade flows—while others are still figuring out execution.

Read More: New Zealand–India Zero Duty Trade Explained: What Importers Need to Know

Where Manufyn Fits in the New Zealand–India Trade Shift

Trade agreements remove barriers, but they don’t manage how businesses actually work together. This gap between policy and practice is where most value is either created—or lost.

Manufyn sits in this gap. It helps businesses operate confidently within evolving trade frameworks by focusing on:

- Structure: supporting repeatable, compliant trade rather than one-off transactions

- Readiness: working with partners that understand origin, documentation, and operational expectations

- Scalability: enabling trade relationships that hold up as volumes, scrutiny, and complexity increase

Rather than treating zero duty as a pricing lever, Manufyn supports businesses in building durable trade capability—so advantages gained from policy changes are sustained in practice.

Preparing for New Zealand–India trade after zero duty?

Manufyn helps businesses move from policy awareness to practical, scalable trade execution—without costly missteps.

Why This Trade Shift Matters Beyond Zero Duty

Zero duty is the most visible change—but it’s not the most important one. The deeper impact of the New Zealand–India trade shift lies in confidence, alignment, and long-term intent between two economies operating at different but complementary scales.

Beyond tariffs, this shift signals:

- Stronger bilateral confidence: Businesses are more willing to invest time, tooling, and resources when trade terms are stable.

- Supply chain diversification: New Zealand–India trade becomes part of a broader move away from single-country dependence.

- Process-led global trade: As agreements mature, success depends less on arbitrage and more on execution discipline.

For businesses globally, this FTA acts as a reference point. It shows how modern trade agreements are less about opening doors—and more about who is prepared to walk through them consistently.

Key Takeaways: What Actually Changes After Zero Duty

To summarize the practical reality:

- Zero duty changes behaviour, not just pricing

- Cost predictability matters more than short-term savings

- Partner expectations rise as tariff barriers fall

- Risk shifts toward origin, documentation, and execution

- Early movers compound advantage over time

- Structure and readiness separate winners from followers

Businesses that understand these shifts don’t just adapt—they lead.

FAQs: New Zealand–India Trade After Zero Duty

After zero duty, trade shifts from being price-led to process-led. Tariffs are removed, but expectations around compliance, partner reliability, documentation accuracy, and long-term execution increase significantly.

Not automatically. Zero duty removes customs tariffs, but GST, logistics, compliance, and operational costs remain. The biggest benefit is cost predictability, not instant price drops.

Zero duty encourages longer-term trade relationships. Businesses move away from one-off transactions and prefer stable partners who can support consistent, compliant trade over time.

While tariff risk decreases, compliance and execution risks increase. Errors in origin documentation, classification, or partner readiness can lead to delays, audits, or loss of zero-duty benefits.

Many businesses focus only on tariff removal and ignore operational readiness. Without strong documentation, origin clarity, and repeatable processes, zero duty advantages often collapse in practice.

After zero duty, businesses prioritise reliability, compliance discipline, and scalability over lowest price. Partners that cannot sustain consistent execution are filtered out quickly.

Early movers align partners, test processes, and fix compliance gaps before trade volumes increase. This allows them to scale smoothly once zero duty is active.

No. In fact, enforcement typically becomes stricter under free trade agreements. Zero duty benefits apply only when origin rules and documentation requirements are met precisely.

Zero duty is a long-term structural change, not a temporary incentive. It signals deeper economic alignment and rewards businesses that invest in durable trade capability.

Preparation involves focusing on partner readiness, documentation accuracy, origin transparency, and scalable execution—not just pricing or policy awareness.

Navigating New Zealand–India trade after zero duty?

Manufyn helps businesses translate free trade agreements into practical, scalable trade outcomes—beyond headlines and policy announcements.