New Zealand–India Zero Duty Trade Explained: What Importers Need to Know

The new zealand india zero duty trade framework marks a fundamental change in how goods move from India into New Zealand. With import duties set to be eliminated under the concluded India–New Zealand Free Trade Agreement (FTA), New Zealand importers stand to see a direct shift in landed costs, pricing flexibility, and long-term trade certainty.

This guide explains the agreement strictly from an importer’s perspective—what zero duty actually means at the border, how it differs from standard tariff treatment, and why understanding eligibility and timelines matters. If you import goods from India (or are considering doing so), this explainer clarifies the mechanics without drifting into exporter or manufacturing strategy.

What Is Zero Duty Trade Between New Zealand and India?

Zero duty trade refers to the elimination of customs import duties on eligible goods traded between two countries under a formal trade agreement. In the case of New Zealand and India, the concluded FTA provides a framework where imports entering New Zealand from India can attract a 0% customs duty, provided they meet the agreement’s conditions.

Zero duty trade refers to the elimination of customs import duties on eligible goods traded between two countries under a formal trade agreement. In the case of New Zealand and India, the concluded FTA provides a framework where imports entering New Zealand from India can attract a 0% customs duty, provided they meet the agreement’s conditions.

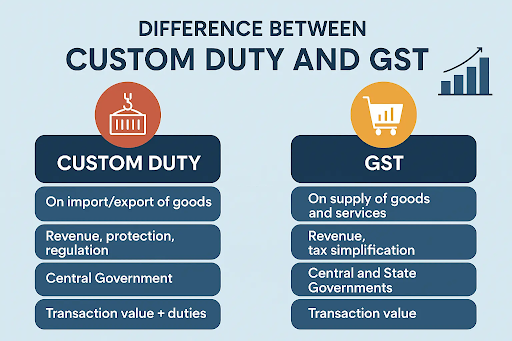

Under normal circumstances, imported goods are subject to:

- A customs duty (based on tariff schedules)

- Goods and Services Tax (GST)

- Freight, insurance, and compliance-related charges

Zero duty trade removes only the customs duty component. It does not remove GST or other statutory requirements. For importers, this distinction is critical: savings come from tariff elimination, not from relaxed compliance.

In practical terms, zero duty trade:

- Lowers the landed cost of eligible imports

- Reduces tariff-related price uncertainty

- Applies only to goods that qualify under the FTA rules

It is also important to note that zero duty is not automatic. Eligibility depends on the product’s origin and documentation—not simply where it is shipped from.

Ready to use zero-duty imports from India—without compliance risk?

Zero duty benefits only apply when origin, HS codes, and documentation are correct.

Manufyn helps New Zealand importers work with export-ready Indian suppliers who understand FTA requirements.

India–New Zealand Free Trade Agreement Explained for Importers

The India–New Zealand Free Trade Agreement is a bilateral trade pact designed to reduce barriers to trade in goods and services between the two countries. After negotiations resumed in early 2025, the agreement was concluded in a record timeframe and is expected to be signed shortly, with implementation planned for 2026.

For New Zealand importers, the agreement matters because it:

- Establishes preferential tariff treatment for goods imported from India

- Creates a rules-based system for claiming zero duty

- Provides long-term certainty compared to temporary tariff relief measures

From an importer’s standpoint, the FTA does not change how customs processes work—it changes how much duty is payable when goods qualify. Import documentation, origin verification, and compliance checks remain in place, but the duty line item on eligible imports moves to zero.

The agreement is structured to support predictable, long-term trade, which is why importers who understand the framework early are better positioned to benefit once zero-duty treatment comes into force.

How Zero Duty Trade Changes Import Costs for New Zealand Businesses

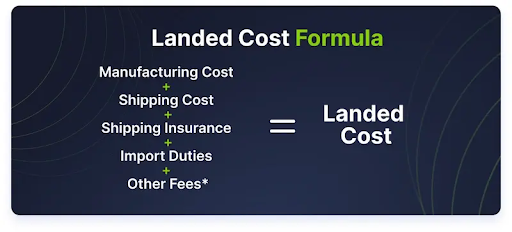

For importers, the most immediate impact of New Zealand–India zero duty trade is on landed cost. To understand the benefit clearly, it’s important to separate what changes from what stays the same.

Import Costs Before Zero Duty

Under standard tariff treatment, the landed cost of goods imported into New Zealand typically includes:

- Product value (FOB or CIF)

- Customs duty (based on tariff classification)

- Freight and insurance

- Goods and Services Tax (GST)

- Customs clearance and compliance costs

Even relatively low tariff rates can materially affect margins—especially for regular or high-value imports.

Import Costs After Zero Duty

Once zero duty applies under the FTA:

- Customs duty is reduced to 0% for eligible goods

- GST, freight, insurance, and compliance costs still apply

- Documentation and origin verification remain mandatory

The removal of customs duty reduces the tax base used to calculate GST, which can further improve cash flow outcomes for importers.

Where Importers See the Biggest Impact

Zero duty trade benefits importers most when:

- Goods previously attracted moderate to high tariff rates

- Import volumes are consistent or recurring

- Pricing is fixed or margin-sensitive

- Long-term supplier contracts are in place

For many businesses, this translates to:

- Improved margins without changing supplier pricing

- Greater flexibility in retail or wholesale pricing

- Reduced exposure to future tariff volatility

Why Understanding This Early Matters

Zero duty does not require renegotiating supply contracts to create value. The advantage comes from structural cost removal, which compounds over time. Importers who understand how the duty component fits into their landed cost are best positioned to model real savings once the agreement is implemented.

Which Imports Qualify Under New Zealand–India Zero Duty Trade?

Zero duty treatment under the New Zealand–India FTA applies only to qualifying goods. For importers, eligibility is determined by origin, not by the supplier’s location, shipping route, or commercial invoice alone.

What “Qualifying Imports” Means

An import qualifies for zero duty when:

- The goods originate in India as defined by the FTA

- The product meets the agreement’s rules of origin

- The required origin documentation is provided at the time of import

If these conditions are met, customs duty on the import is reduced to 0%.

Broad Coverage (High-Level)

While the final schedules determine eligibility in detail, the agreement is structured to cover a wide range of traded goods, rather than a narrow product list. For importers, the key takeaway is:

- Eligibility is product- and origin-based, not importer-specific

- Zero duty is applied at the border, not through refunds later

What Does Not Automatically Qualify

Importers should be aware that zero duty does not apply when:

- Goods are merely shipped from India but manufactured elsewhere

- Products undergo minimal processing that does not meet origin thresholds

- Documentation is incomplete or incorrect

Understanding this distinction early prevents delays, reassessments, or duty clawbacks.

Rules of Origin Explained (In Simple Importer Terms)

Rules of origin are the mechanism that customs authorities use to decide where a product is considered to be made. Under the New Zealand–India FTA, these rules determine whether an import is eligible for zero duty.

Why Rules of Origin Matter to Importers

From an importer’s perspective, rules of origin:

- Decide whether zero duty applies

- Protect the agreement from misuse

- Ensure benefits are limited to genuine trade between the two countries

Even when goods are invoiced by an Indian supplier, customs will assess where and how the product was produced.

How Origin Is Typically Determined

While the technical criteria vary by product, origin is usually established through:

- Substantial transformation in India

- Value addition thresholds

- Product-specific manufacturing requirements

Importers do not need to interpret these rules themselves—but they do need to ensure compliance through correct documentation.

The Role of the Certificate of Origin

To claim zero duty, importers will typically need:

- A valid certificate of origin issued by an authorised body

- Accurate HS code classification

- Consistency across commercial invoices, packing lists, and shipping documents

Without proper origin proof, customs will apply standard duty rates, even if the goods would otherwise qualify.

Common Importer Mistakes to Avoid

- Assuming all India-linked goods qualify automatically

- Treating rules of origin as a post-clearance issue

- Submitting incomplete or mismatched documentation

- Relying solely on supplier assurances without verification

For importers, rules of origin are not a legal technicality—they are the gateway to zero duty.

When Will New Zealand Importers Start Getting Zero Duty Benefits?

Although the India–New Zealand Free Trade Agreement has been concluded, zero-duty treatment does not apply immediately. For importers, understanding the timing is essential to avoid incorrect cost assumptions at the border.

Expected Timeline (Importer View)

- Agreement concluded: Announced by both governments

- Signing: Expected within the coming months

- Implementation: Targeted for 2026, subject to domestic legal and administrative steps

Zero duty becomes available only after formal implementation. Imports cleared before the effective date will continue to attract standard tariff rates, even if the goods would qualify later.

Why There Is a Gap Between Signing and Zero Duty

Trade agreements require:

- Legal ratification in both countries

- Customs system updates

- Publication of tariff schedules and origin rules

For importers, this means zero duty is a date-specific benefit, not a retroactive one.

What Importers Should Watch For

- Official notice of the effective date

- Publication of FTA tariff schedules

- Customs guidance on claiming preferential treatment

Until these are in place, import entries should be costed using existing tariff rates.

What Zero Duty Trade Does Not Change for Importers

Zero duty reduces costs—but it does not simplify or remove New Zealand’s import controls. Being clear on this prevents costly misunderstandings.

What Still Applies

- GST: Still payable at the prevailing rate

- Customs documentation: Invoices, packing lists, HS codes, origin proof

- Biosecurity & standards checks: Unchanged

- Border inspections and audits: Still in force

Zero duty affects only the customs duty line item—nothing else.

What Zero Duty Does Not Mean

❌ No paperwork

❌ Automatic eligibility

❌ Faster clearance by default

❌ Removal of compliance obligations

For importers, the benefit is financial—not procedural.

Common Importer Misconceptions About Zero Duty Trade

Clearing up these misconceptions early helps importers avoid delays, reassessments, or unexpected charges.

- “All imports from India will be duty-free.”

→ Only qualifying goods with valid origin proof qualify. - “Zero duty means no taxes.”

→ GST and other charges still apply. - “We can claim zero duty later.”

→ Preferential treatment must be claimed at import, with correct documents - “It’s better to wait until implementation.”

→ Importers who understand eligibility early are better positioned when zero duty begins.

Why Zero Duty Trade Matters for New Zealand Importers (Long Term)

From an importer perspective, zero duty trade offers:

- Structural cost reduction, not temporary relief

- Greater pricing predictability

- Reduced exposure to future tariff changes

- Stronger confidence in long-term New Zealand–India trade flows

The biggest advantage accrues to importers who understand the rules, timelines, and limitations—rather than those who treat zero duty as a headline-only benefit.

Where Manufyn Fits In for New Zealand Importers

Understanding zero-duty trade is only one part of the equation. For New Zealand importers, the real challenge begins after the policy—ensuring imports actually qualify for zero duty without cost overruns, compliance issues, or supply risk.

This is where Manufyn fits in from an importer-first perspective.

Translating Zero-Duty Policy Into Import-Ready Execution

Under the New Zealand–India zero duty trade framework, importers must ensure:

- Goods genuinely originate in India

- Suppliers can provide valid certificates of origin

- Documentation aligns across invoices, HS codes, and shipping records

Manufyn helps reduce importer-side risk by working with export-ready Indian manufacturers that already operate within structured compliance and documentation frameworks—making zero-duty eligibility easier to validate.

Reducing Importer Risk Before Goods Reach the Border

For importers, the biggest risks under FTAs are:

- Incorrect origin claims

- Documentation mismatches

- Inconsistent supplier processes

Manufyn acts as a pre-border filter, helping importers engage with suppliers who understand international trade requirements—reducing the likelihood of duty reassessments, delays, or rejected claims at New Zealand customs.

Designed for Importers Who Value Predictability

Rather than focusing on one-off transactions, Manufyn supports importers who need:

- Consistent product origin

- Repeat imports under the same FTA framework

- Long-term cost predictability once zero duty is implemented

This aligns directly with the intent of the India–New Zealand FTA: stable, rules-based trade, not opportunistic importing.

Why This Matters Under Zero-Duty Trade

As more importers begin using zero-duty provisions, scrutiny at the border typically increases—not decreases. Importers who rely on structured supplier ecosystems are better positioned to benefit consistently from tariff elimination.

Manufyn exists to support that consistency—bridging trade policy with practical, importer-safe sourcing from India.

Conclusion: What New Zealand Importers Should Take Away

The New Zealand–India zero duty trade framework is a structural change, not a short-term incentive. It lowers costs by removing customs duty on eligible imports—but only when origin rules, documentation, and timing are handled correctly.

For importers, the opportunity lies in:

- Understanding eligibility and rules of origin

- Tracking implementation timelines

- Maintaining accurate, consistent documentation

- Treating zero duty as a long-term cost and risk management tool

Those who approach the FTA with clarity—not assumptions—will capture the most reliable benefits as zero-duty trade comes into effect.

FAQs: New Zealand–India Zero Duty Trade

It means customs import duty is reduced to 0% on eligible goods under the FTA. Other costs—GST, freight, insurance, and compliance—still apply.

No. Zero duty applies only to qualifying goods that meet the FTA’s rules of origin and are supported by valid documentation at the time of import.

Only after formal implementation of the FTA (targeted for 2026). Imports cleared before the effective date will continue to attract standard tariffs.

Typically:

- A valid certificate of origin

- Correct HS code classification

- Matching commercial invoice, packing list, and shipping documents

Missing or incorrect paperwork can result in standard duty being charged.

No. GST remains payable under New Zealand law. Zero duty affects only the customs duty component.

Preferential treatment generally must be claimed at import with correct documents. Retrospective claims are limited and not guaranteed.

They do not qualify. Eligibility is based on origin, not shipping point. Goods must meet the FTA’s origin criteria.

Not automatically. Clearance times depend on documentation accuracy and compliance. Zero duty is a cost benefit, not a procedural shortcut.

Planning to import from India under the zero-duty trade framework?

Manufyn works with New Zealand importers to ensure India-origin goods qualify for zero duty—without surprises at the border.